English • Deal

Diverging Demand for Mega Sheds: Ansan Draws Six Bidders, Cheongna Gets Two

Cheongna vs. Ansan: same-grade hardware, different heat. Tenant CAPEX and risk dispersion made the difference.

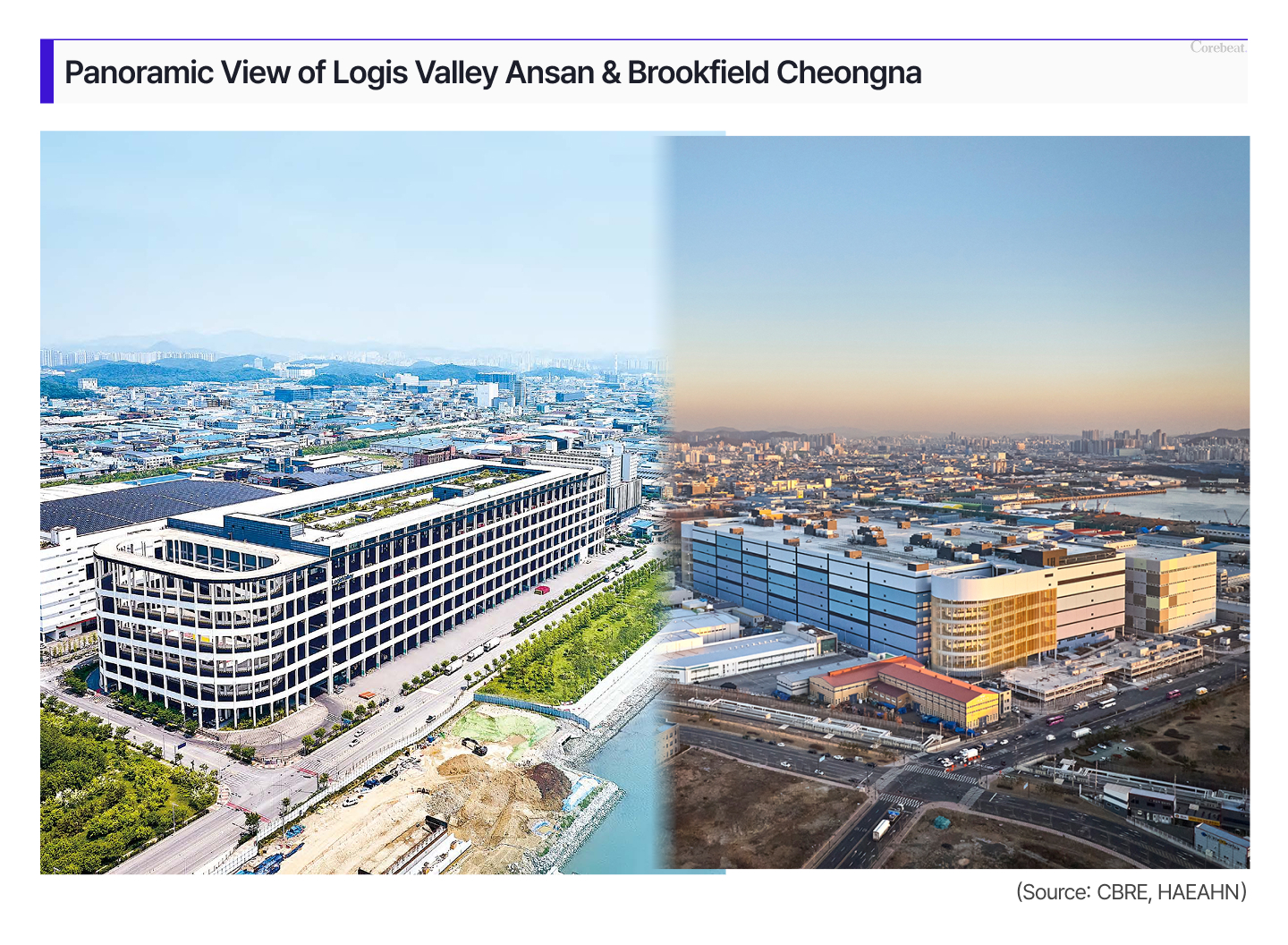

Two headline logistics sales that have been on every buyer’s radar just delivered very different levels of interest. The LogisValley Ansan Logistics Center (“Ansan”) saw a crowded field, while the Cheongna Logistics Center (“Cheongna”) drew a modest response despite being newer, larger, and closer to Seoul.

On August 7, six firms submitted bids for Ansan: Gravity Asset Management, IGIS Asset Management, Widecreek Asset Management, Hangang Asset Management, Create Asset Management, and Koramco Asset Management. The asset, located in Seonggok-dong, Danwon-gu, Ansan (Gyeonggi Province), was completed in June 2019 and is a 100% ambient facility.

By contrast, the July 22 bid round for Cheongna attracted just two parties: KKR–Create Asset Management and IGIS Asset Management. Cheongna is owned by Brookfield Asset Management and sits in Woncang-dong, Seo-gu, Incheon. It’s a mixed ambient/cold facility (roughly 80% ambient, 20% cold) delivered in November 2022.

Why the newer asset underwhelmed vs Why Ansan drew a crowd

On paper, Cheongna has the edge: more modern specs, Seoul-proximate, and scale. But three headwinds blunted appetite:

-

Pricing: Guidance reportedly in the KRW 1 trillion range—heavy for today’s return hurdles.

-

Concentration: A de-facto single-tenant structure anchored by Coupang. Long leases help stability, but if the tenant contracts or exits, backfill risk is binary.

-

Supply overhang: Incheon’s logistics pipeline has been busy, and buyers priced that risk.

But, CBRE IM asset drew more interest:

Entry basis: An indicative price near KRW 500 billion, roughly half of Cheongna’s talk, lowered basis risk.

-

Tenant mix: Coupang, LF, and 7-Eleven diversify cash flows and reduce vacancy shock.

-

Sticky CAPEX by tenants: Coupang: reportedly invested KRW 100+ billion, LF: reportedly invested KRW 30+ billion

In logistics, tenant CAPEX (capital expenditure) goes into automation, HVAC upgrades, racking, and layout reconfiguration.

When tenants put real money into the box, it typically signals commitment, extends dwell time, and preserves the building’s competitive edge—factors buyers translate into lower underwritten downtime and stronger exit liquidity.

Read-through for investors

The split outcome underscores where capital is migrating in 2025: basis discipline, diversified tenancy, and tenant-backed CAPEX are outranking “newer and nearer to Seoul” when those come with single-tenant risk and full pricing.

Expect investors to keep triangulating tenant mix, CAPEX intensity, and local supply—not just headline specs—when sizing up Korean logistics deals.