English • Market

Korea’s Domestic Institutions Re-Engage the Logistics Market as Core Funds Begin Deployment

Large-scale ambient logistics assets in the Seoul metropolitan area draw renewed attention from local capital

Earlier this year, Korea’s National Pension Service (NPS) selected three domestic asset managers to execute core logistics strategies as part of its long-term real estate allocation. Following several months of fund structuring and capital commitment procedures, those platforms are now entering their active deployment phase — and the first transactions are beginning to emerge in the Korean logistics market.

Samsung SRA Asset Management is pursuing the acquisition of the Anseong Daedeok Logistics Center, while Capstone Asset Management is advancing the Arenas Yeongjong transaction.

While still limited in scale, the return of NPS-backed core capital is now being closely watched as a potential inflection point for Korea’s logistics investment market.

From Pandemic-Era Oversupply to a Foreign-Led Market

Korea’s logistics sector was heavily impacted by oversupply during the COVID-19 period, when aggressive development was driven by surging e-commerce demand. As new supply flooded the market and interest rates rose sharply, asset performance weakened across the sector.

Although the market has begun to show early signs of stabilization and recovery since 2024, domestic institutional investors have largely remained on the sidelines, restrained by lingering caution shaped by the prior downturn.

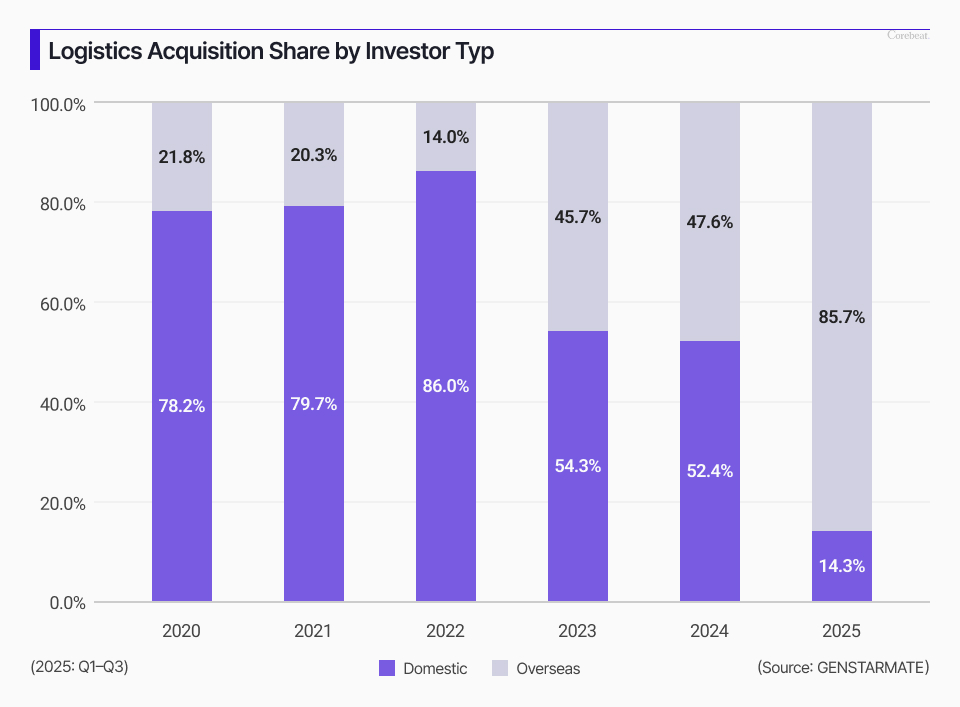

Foreign investors stepped in to fill the investment vacuum. According to GenstarMate, overseas capital accounted for 86% of nationwide logistics acquisitions through the third quarter of 2025. In the Seoul metropolitan area, virtually all transactions were executed by non-Korean buyers, underscoring how completely local institutions had stepped back from the sector.

Against this backdrop, the re-emergence of domestically sponsored core capital — even in selective assets — is drawing quiet but growing attention from the market.

Among the two transactions, market attention has particularly converged on Arenas Yeongjong.

Completed in 2021, the asset is a large-scale prime ambient logistics facility with a total gross floor area of approximately 186,000 square meters. Current tenants include Samsung SDS’s logistics subsidiary, the Korean arm of China’s SF Express, and the local subsidiary of U.S.-based life sciences company Thermo Fisher Scientific. Vacancy remains below 7%.

Based on current lease conditions and the estimated acquisition price, Corebeat Research estimates the asset’s cap rate at approximately 5.0%. This is higher than this year’s Gonjiam logistics center transaction (4.7%) but lower than the Icheon Logistics Center No.4 deal (5.3%). Within the prevailing pricing range for stabilized ambient logistics assets with high-quality tenants, Arenas Yeongjong falls within the core asset category.

From a locational perspective, however, the asset is not entirely conventional. Situated near Incheon International Airport, the center was originally designed to serve air-cargo-related logistics. During the pandemic, the collapse of duty-free retail and air cargo volumes led to widespread lease cancellations, exposing structural vulnerabilities in its tenant base.

While tenant demand has since recovered and the project successfully established logistics demand in an area that previously lacked such infrastructure, tenant diversification remains narrower than that of inland logistics hubs with broader generic demand.

A Signal on ‘What Matters’ in Korea’s Logistics Market

Despite these locational idiosyncrasies, the fact that NPS capital is being deployed through a core strategy is being interpreted as a signal that the investment logic for large-scale ambient logistics assets in the Seoul metropolitan area has regained structural legitimacy.

The focus appears to be less on micro-locational uniqueness and more on the physical core specifications of the asset — namely, “Seoul metro, ambient, large-scale” facilities that can sustain long-term institutional ownership.

According to GenstarMate, vacancy in Seoul-area ambient logistics centers stood at 12.8% in the third quarter. While still elevated, the vacancy trend has begun to stabilize. The firm notes that as e-commerce-driven third-party logistics (3PL) expands, tenant demand is increasingly concentrating on facilities capable of delivering both operational efficiency and economies of scale.

It expects leasing conditions for large-scale logistics centers in the southeastern metropolitan corridor to normalize at a faster pace.

NPS as a Quiet Reference Player

Beyond the assets themselves, the symbolic role of NPS is also shaping market expectations. As Korea’s de facto reference allocator, NPS plays an understated but influential role in guiding domestic institutional behavior.

Once NPS begins deploying capital in a given sector, other pensions and mutual aid associations typically feel greater flexibility to revisit their own investment frameworks.

Market sources indicate that several domestic mutual aid associations have recently resumed internal reviews of logistics investments, some initially through preferred equity structures.

After nearly two years of near-total institutional retreat, Korea’s logistics market is seeing domestic capital quietly return to the discussion table — with NPS-backed core funds at the center of that renewed attention.