English • Market

Logistics Is Moving Again

Foreign capital moved first — will domestic money follow?

2025 was not a loud year for Korea’s logistics market. But it was a revealing one.

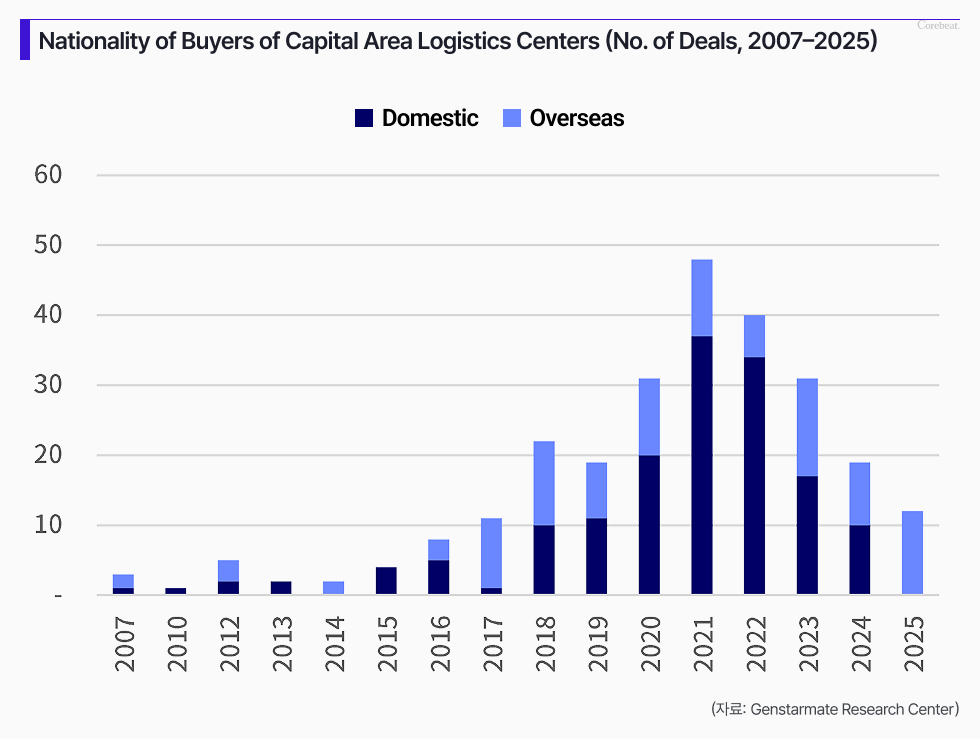

Every logistics transaction closed in the Seoul Capital Area last year was led by foreign capital. According to GenstarMate, this marked the first time since 2014 that all closed deals were taken by overseas investors. Domestic capital stayed on the sidelines.

The market restart, however tentative, began elsewhere.

At the center of that restart stood KKR.

KKR reopened the market

KKR closed four logistics acquisitions in Korea during 2025. The sequence itself told a story: Anseong Seonwoo Logistics & C&D, Icheon 4 Logistics Center, Hwaseong Jegiri Logistics Center — and finally, Brookfield Cheongna.

That final deal set the tone.

KKR acquired Brookfield Cheongna for approximately KRW 1.1 trillion (around USD 830 million), the largest single-asset logistics transaction ever recorded in Korea.

The timing mattered. As the year drew to a close and liquidity remained tight, the transaction sent a clear signal to the market: price uncertainty, at least for prime assets, had reached a point of acceptance.

Core money returns — selectively

KKR was not alone.

LogisValley Ansan, another headline deal, saw M&G take the lead through its M&G Asia Property (MAP) Fund. The transaction totaled KRW 512.3 billion (approximately USD 390 million). Domestic pensions, including Teachers’ Pension and the Fire Officers’ Pension, participated only as minority co-investors.

Earlier in the year, GIC emerged as a key investor in Greenwave Sihwa Logistics Center and Incheon Hangdong Dream Logistics Center. In the third quarter, Blackstone acquired a portfolio including LogisValley Seoul Gimpo Logistics Center and MQ Logistics.

The pattern was consistent.

Foreign capital moved first — and only into assets with clear location advantages, stabilized tenants, and defensible fundamentals. Core money, not opportunistic capital, dominated the field.

Why foreign capital stepped in

Korea’s logistics sector expanded aggressively during the COVID years, driven by expectations of sustained e-commerce growth. Supply arrived fast. Demand did not scale as expected.

Vacancies rose. Rents softened. Rate hikes and construction cost inflation followed. Domestic capital, having absorbed losses during the downturn, effectively stepped away from the sector.

Against that backdrop, the closing of large, symbolic transactions like Brookfield Cheongna and LogisValley Ansan played an important role. These deals eased lingering fears of “further price downside” and helped form a new consensus on risk and valuation.

That said, caution remains. The assets that traded were undeniably prime. Few market participants are willing to declare a full recovery based on a narrow set of transactions.

2026: the real test begins

Which is why attention is now shifting to 2026.

New logistics completions in the Seoul Capital Area are expected to decline materially, easing pressure on vacancy rates. The rate environment remains uncertain, but the probability of a shock on the scale of 2023–2024 appears limited.

The key question is domestic institutional capital.

In 2025, domestic pensions appeared only on the margins — Teachers’ Pension in LogisValley Ansan, and the Local Government Officials’ Pension in Brookfield Cheongna. None led.

That may be changing.

Ongoing transactions such as Arenas Yeongjong and Anseong Daedeok Logistics Center are drawing attention as National Pension Service’s core platform fund is reportedly under active consideration.

NPS is not just another investor. It functions as a reference allocator. When NPS moves, psychological barriers for other institutions tend to fall.

Notably, these potential investments are all being structured through core funds — targeting stable cash flow, long-term holds, and capital preservation. The logic mirrors MAP’s acquisition of LogisValley Ansan in 2025.

If these deals materialize, logistics assets may once again be viewed as long-term hold candidates — not tradeable recovery plays, but normalized institutional assets.

2025 showed where the floor might be. 2026 will decide whether domestic capital is ready to agree.